If those medications use co-payment coupons to circumvent your benefit design then I suggest the answer is yes.

From RxObserver:

"PBM Express Scripts was recently in the news for announcing that its 2014 formulary would exclude from all coverage 48 prescription products. Some 93% of the newly excluded products use copay coupons to get around plan design features intended to encourage plan beneficiaries to use less expensive, but equally effective prescription drugs. "

Thursday, January 09, 2014

Thursday, December 12, 2013

Key drug approval: Solvadi for Hepatitis C

- Expect lots of hepatitis C patients to receive this medication since it can be used without an interferon. Patients dislike taking interferons since it makes them feel like they have the flu every time the receive it.

- It costs $84,000 for the 12-week treatment.

Press release

Express Scripts claims they will aggressively pit the multiple hepatitis C treatments against each other in an effort to lower costs without lowering quality. Here's the Drug Channels link. I'll be interested to see if they can pull that off.

Office administration of specialty infusion drugs may be less expensive than home infusion.

Here's a link to a very informative article from Drug Channels. This chart highlights how relying on your PBM for all specialty drugs might not be the best idea.

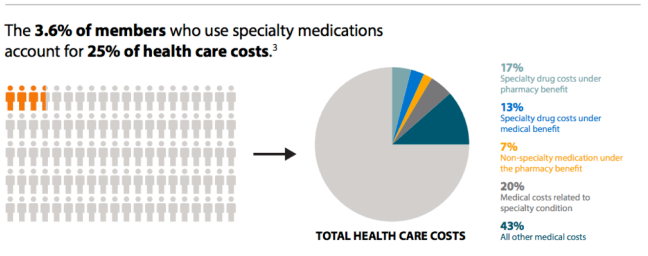

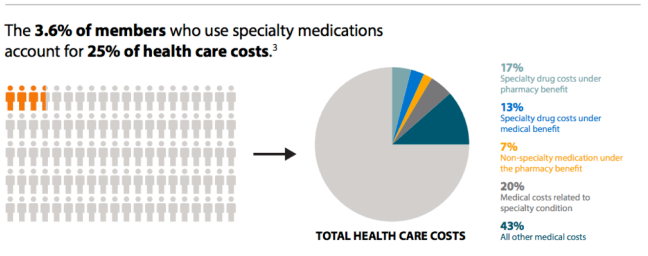

Another from Enabling Health Decisions. The question is whether care can be improved or cost reduced for these 3.6% of members. Your care management vendor should be providing you with those answers.

Another from Enabling Health Decisions. The question is whether care can be improved or cost reduced for these 3.6% of members. Your care management vendor should be providing you with those answers.

Tuesday, November 12, 2013

Outpatient Drug Approvals for October 2013

Zohydro ER (hydrocodone)

Extended-Release Capsules

Treatment for: Pain

Zohydro ER

(hydrocodone) is a single-entity (without acetaminophen) extended-release

opioid analgesic for around-the-clock management of moderate to severe chronic

pain.

Comments: Like Oxycontin, this medication can provide

needed relief to true severe pain patients but will be abused by many others.

-more-

-more-

Friday, November 08, 2013

Independent Pharmacy Profit Margins Not Driving Rising Medication Costs

Per Drug Channels: "Given the slight increase in gross margin, gross profit dollars per prescription grew slightly, from $12.40 per prescription in 2011 to $12.61 per prescription in 2012."

While you can save some money using a preferred pharmacy network a focus on improving prescribing habits presents a far greater opportunity for savings and improved quality.

Update: 11/14/13

Wal-Mart recently aired commercials promoting their preferred pharmacy network option. If you're interested in a preferred network please note that CMS found that of 13 plans reviewed there were eight (8) that were less expensive and five (5) that were more expensive than the traditional plan. It's not enough to just choose to use a preferred network. You need a solid analysis of savings, guarantees of those savings and audits to confirm.

While you can save some money using a preferred pharmacy network a focus on improving prescribing habits presents a far greater opportunity for savings and improved quality.

Update: 11/14/13

Wal-Mart recently aired commercials promoting their preferred pharmacy network option. If you're interested in a preferred network please note that CMS found that of 13 plans reviewed there were eight (8) that were less expensive and five (5) that were more expensive than the traditional plan. It's not enough to just choose to use a preferred network. You need a solid analysis of savings, guarantees of those savings and audits to confirm.

Wednesday, October 23, 2013

National Health Expenditures

Abstract from Health Affairs article

Unfortunatlely, the article isn't free.

"Health spending growth through 2013 is expected to remain slow because of the sluggish economic recovery, continued increases in cost-sharing requirements for the privately insured, and slow growth for public programs. These factors lead to projected growth rates of near 4 percent through 2013. However, improving economic conditions, combined with the coverage expansions in the Affordable Care Act and the aging of the population, drive faster projected growth in health spending in 2014 and beyond. Expected growth for 2014 is 6.1 percent, with an average projected growth of 6.2 percent per year thereafter. Over the 2012–22 period, national health spending is projected to grow at an average annual rate of 5.8 percent. By 2022 health spending financed by federal, state, and local governments is projected to account for 49 percent of national health spending and to reach a total of $2.4 trillion."

Note the acceleration in prescription sales starting in 2014. Much of this will come from increasing specialty drug sales. It's a good time to start talking to your PBM about how to manage this growth.

Co-pay Discount Cards = Poor Value

At least in most cases. Express Scripts recently dropped 48 brand-name drugs from their preferred formulary. The drug companies offer co-pay cards for 93% of them. You should consider asking your PBM for their approach to these same drugs.

Here's a link to a list of co-pay cards and coupons. If you see a drug on this list it likely means it is unnecessarily expensive.

Here's a link to a list of co-pay cards and coupons. If you see a drug on this list it likely means it is unnecessarily expensive.

Subscribe to:

Posts (Atom)